Another 6-figure exit, and the future

I sold Xnapper, here is a quick update about the acquisition details

Hello everyone, it’s Tony! 👋

One of my products - Xnapper - has been acquired for $150,000

If you are a long-time subscriber, you probably know I shared about “a new screenshot app” in my June 2022 newsletter issue. I also shared the building and launching story of Xnapper on the Indie Hackers forum.

Today, I want to write a short update to keep you all updated about the acquisition and share some more thoughts on the future of my indie journey.

Reason for selling

As shared in my last newsletter’s issue, the main reason I want to sell Xnapper is that I feel like I’m wasting its potential.

With Typing Mind making $40K+/month, I don’t have much time or motivation left to work on Xnapper, so I decided to clean up my portfolio a bit.

Normally, I would be fine letting the product run on auto-pilot. Like DevUtils, Xnapper is a one-time purchase macOS app, with very low maintenance effort.

However, for Xnapper, I think it has much more room to grow, and letting it on auto-pilot is very wasteful.

There are many screenshot apps on the niche macOS market, but the truly good ones are only a few. Xnapper was lucky to receive so much love and support from its users. I really believe it has a shot of becoming the #2 or even #1 screenshot app for macOS.

But, as I said, I don’t have much time or motivation. So, I thought selling it was the best path forward.

How I find the buyer

I found Brian (the buyer) on Twitter from my tweet. Having an audience is great for cases like this!

Via our video calls, I find Brian an enthusiastic and energetic entrepreneur who really believes in the future of Xnapper.

I also listed Xnapper on Acquire.com around the same time. Later, I received one other offer at a higher price of $169K, but I had already accepted Brian’s offer, so I moved forward with the deal with Brian.

One thing about Acquire.com I learned is that they now charge you a 4% fee on the total acquisition deal value if you find the buyer via their network, which is not a small number! That would have cost me $6,000 in fees for Xnapper’s acquisition!

Normally, a transaction via escrow.com is less than 1%.

The process

In case you never know how an acquisition happens, here is the process of my acquisition from start to finish.

Prepare the data

Before looking for buyers, I prepared a spreadsheet that contains all the information about the product that the buyer may want to know - a “fact sheet”. It looks like this:

In the tweet where I look for buyers, I include this spreadsheet (now taken offline).

Listing the products on Acquire.com requires a lot of information, but most of them are already available in the sheet, so I just copied them over.

Collect Letter of Intent

I started talking to potential buyers and answering questions they had about the product. Most buyers reached out to me via Twitter DM, and some reached out via Acquire.com.

Once they are happy with what they want to know, some will start to send a Letter of Intent (LOI). In my case, I received Brian’s LOI the next day we had a video call.

The LOI listed some important information about the deal:

Total deal value: $150K

Payment terms: $100K will be paid upfront, and the rest of $50K will be paid monthly via revenue share.

Assets included in the transaction (domain, source code, social accounts, etc.)

Due diligence and other agreements (e.g., non-complete).

As you may have guessed, my personal Twitter account probably influences Xnapper revenue quite a lot. So, we picked a suitable payment term, a mix of upfront and revenue share, that will benefit both of us in the medium term. This gives Brian enough time to explore other marketing channels instead of relying solely on Twitter.

I accepted the LOI from Brian the next day.

Usually, I should wait until I receive some better LOIs from other buyers, but I thought Brian's offer was good enough, and he seems to be very responsive/fast with the process. So, if I move forward with Brian, we can probably close the deal early, which is good.

Due Diligence and Purchase Agreement

Once I accepted the LOI, we started to draft out a Purchase Agreement and schedule a due diligence video call.

I already have a Purchase Agreement template from the last time I sold Black Magic, so the agreement was quick.

The due diligence call was also quick (as I said, Brian is very responsive). So it took us only a few days to finalize everything.

Pay via Escrow, Transfer Assets

Once we had the contract signed via DocuSign, both of us registered an account on Escrow.com and started the transaction. Escrow costs $890, and we split the fees.

The typical flow of purchase on Escrow looks like this:

The buyer and the seller register an account and verify ID/business

The buyer deposits the money to Escrow, they verify the fund

The seller starts transferring the assets (domain, source code, accounts, etc.)

The buyer verifies the assets and then notifies Escrow when all assets are received in good condition.

Escrow transfers the fund to the seller. Transaction closes.

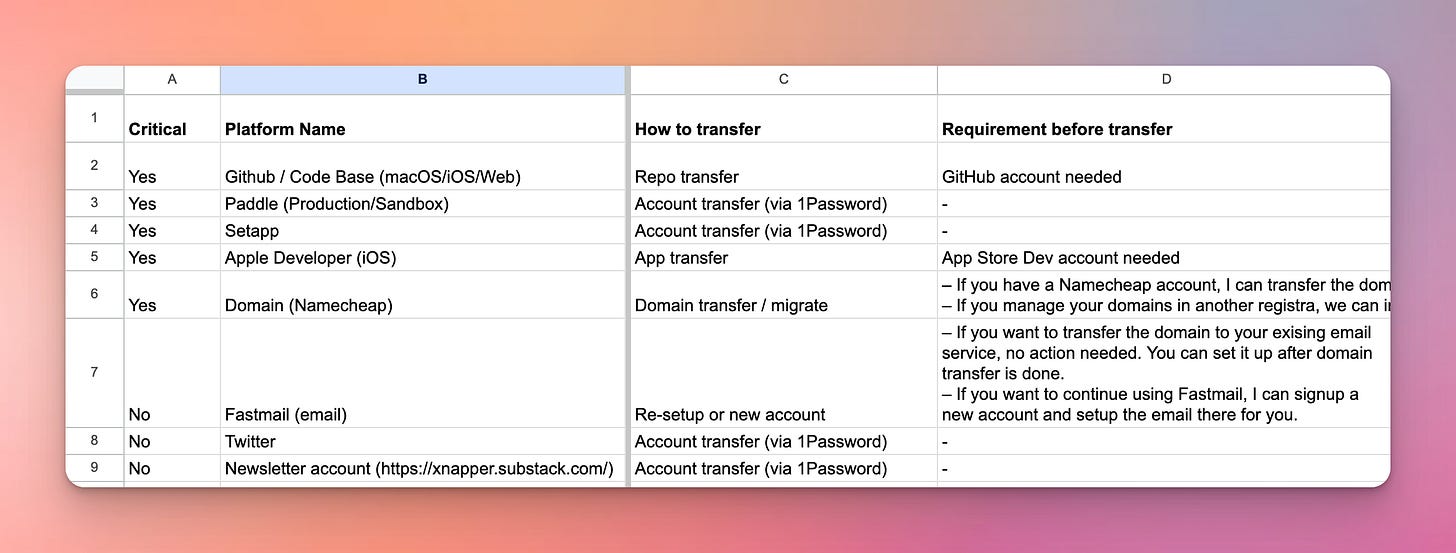

For Xnapper’s assets transfer, I prepared another sheet with the list of all assets that need to be transferred so we can track the status of each item together.

It looks like this:

So that’s the whole process of Xnapper’s acquisition.

The Future

For Xnapper, I think it’s in good hands. Brian is already making progress on growing the app, which I’m happy to see.

For me, this marks my second product acquisition. This time the deal is bigger than the Black Magic acquisition ($128K).

It’s funny that Xnapper, a one-time purchase product with only ~$4K/month revenue, now sold at a higher price than Black Magic, which was making $14K MRR. The solopreneur journey is full of surprises.

During the acquisition, I had an idea: Maybe I can sell every product I own now, get some money, then go back to square one and start exploring other, bigger ideas.

Sounds tempting, but it could be a lot of work and very distracting.

Right now, I only have 2 products left: DevUtils and Typing Mind. I don’t have much motivation to sell either of the products.

DevUtils is nearly feature-complete, cruising nicely on auto-pilot, making revenue stablely every month. Besides, it’s my first successful indie product; I have some emotional attachment to it.

Typing Mind is still too early and too exciting to work on. There are so many unexplored areas, and the whole AI scene is going up. I can’t sell it now!

More on Typing Mind. One thing that stresses me out a bit is the pressure to get more people on the team. I feel like Typing Mind needs a lot more attention than I’m giving it right now, it needs a whole team to push this forward and capture a larger chunk of the growing market. This is judging from the growing demand from customers and inbound leads I got over the past few months.

Me working just 4 hours a day with some freelancers is probably not going to cut it. But I don’t want to work more, I also don’t want to hire and manage a team. Maybe I’ll have to do it eventually, or maybe I will sell the whole thing if someone has a good offer.

In one of my old newsletter issues, I talked about the idea of “Always be selling”:

This time, I might actually do it, let’s see.

That’s all for now!

I hope this month’s issue is helpful to you!

Actually, there is something I want to ask. If you’ve found my newsletter helpful or add some value to you, AND you are a Typing Mind customer, you can help me by leaving a review for Typing Mind:

You can pick any of the above (or all of them if you have time!). I read every review, and it would help me and the product a lot!

Ok, that’s all.

Thanks for reading, and I’ll see you again next month.

Cheers!

- Tony

Nice on you for making this sale so effortless. You really put a lot of time to make it easy for everyone involved!

I’ve attempted to purchase a business online and people usually don’t have all that data so it’s a lot of work to dig through and try to gather all the context about the business. I’m sure that must weigh heavily in the whole process and make your business even more valuable.

Congrats on the sale! Thanks for sharing some details on the process here. The 100/50 split between cash up-front seems like great aligned incentives